- The all-time high price hit by the LYFT share is $66.28.

- The net income of Lyft Inc. for the recent quarter has declined by 69.7%.

Lyft Inc. operates in the transportation sector and was founded in the year 2007. The company currently has more than 4.4K employees and the CEO of the company is John David Risher. Lyft Inc. has its headquarters in San Francisco and is traded as LYFT ticker in the NASDAQ exchange.

The market cap of the LYFT stock is $3.642B following an EPS of -3.57 USD which shows that the company is making a loss on each share. LYFT stock has 322.499M shares floating in the market.

The reported return-on-equity for Lyft Inc. is -272.92% and the ROA of the company is also negative resulting in -29.51%. The average training volume of the LYFT stock followed by the last three months is 13.455M. The last-day trading session’s volume is 1.4K which is too low when compared with the average volume,

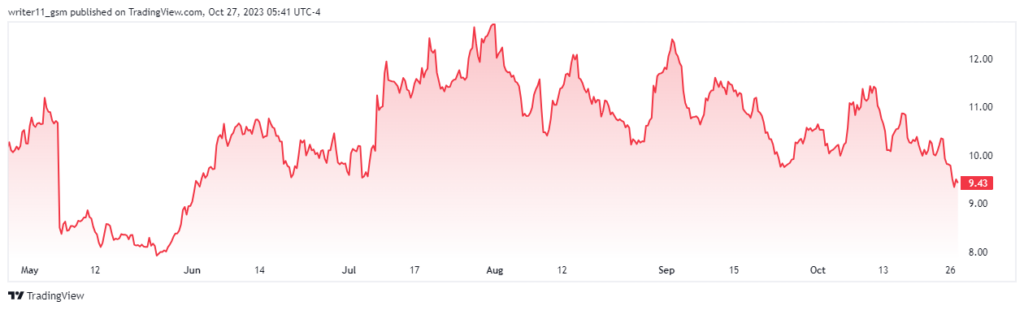

With a beta of 1.97, the 52-week range of the LYFT stock is $7.85-$18.36. The following beta makes the LYFT stock price more volatile than the average of the market. This phenomenon led to the following 52-week range.

Financial Performance Of LYFT Stock

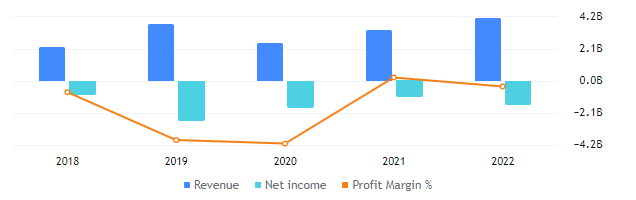

As the revenue of the company is advancing, the debt of the company is also advancing. The reported debt of the company for the year ending 2022 is $1.10B while the revenue is $4.10B. The net income of the company has also declined to -$1.58B resulting in a negative profit margin of -38.69%.

LYFT Stock Price Fails To Close Below The Wedge Pattern, What Next?

a by writer11_gsm on TradingView.com

LYFT stock price is following a very strong downtrend and has given a gap down of more than 30% in just one day in the past. The share price has given multiple huge gap downs in the past which represents how uncertain is the LYFT stock price. Also, the beta of the stock is high resulting in 1.97.

The LYFT stock price is declining to lower lows and has also formed a falling wedge pattern. Forming bearish candlesticks, the share price is declining to lower lows and is currently trading on the verge of the lower band of wedge.

The stock price of the LYFT is also consistently declining below the crucial EMAs. The 50-day and the 200-day EMA on the charts of the LYFT stock are trading in a death cross.

The RSI also failed to sustain above the 50 level and is consistently making lower lows. It is currently trading at 38.15 and has also declined below the 14-day SMA trading at 47.25.

Conclusion

The financials of the company are supporting for the long-term reliability as they haven’t performed well for the last few years. The technicals of the stock are also indicating bearishness. If the LYFT stock price breaks below the falling wedge pattern then it can lead to a fast decline in the price of the stock. There are no signs of a bullish move on the technical chart of the LYFT stock.

Technical Levels

- Support levels– $7.90 and $9.00

- Resistance levels– $11.40 and $12.70

Disclaimer

The information provided in this article, including the views and opinions expressed by the author or any individuals mentioned, is intended for informational purposes only. It is important to note that the article does not provide financial or investment advice. Investing or trading in cryptocurrency assets carries inherent risks and can result in financial loss.