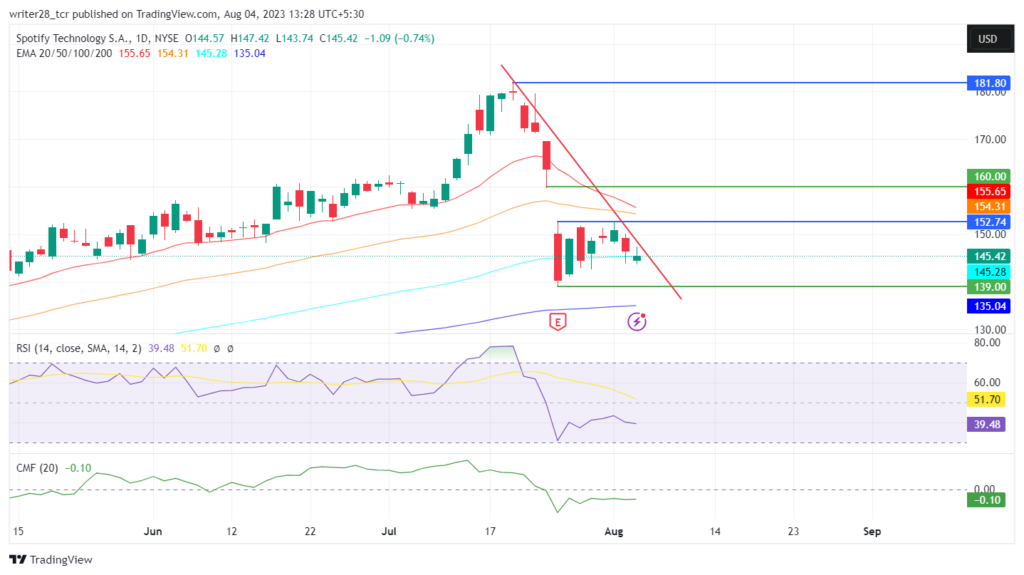

- The Spotify stock price is presently trading at $145.42 while witnessing a decrease of -0.74% during the intraday session.

- Year to date return of SPOT stock price is 77.60%, and the three-month return is 2.90%.

- Taylor Swift’s “Eras Tour” has resulted in recent price increases on Spotify.

Spotify Technology SA is a Swedish-based digital music services provider which operates in two segments, Premium and Ad-support, to offer instance access to global music. With roughly 500 million monthly users, Spotify is the world’s largest music streaming service.

The SPOT stock price is reflecting bearish sentiment in the market. Despite achieving an annual high on July 19, the price faced a rejection near the $182 level; the Spotify stock price has observed a past monthly and weekly return of -9.59% and -3.99%, respectively. These results display the power struggle between the bulls and bears in which bears have got a stronghold.

Since early 2023, the Spotify stock price has increased substantially, from the support level of $79.24 to the recent resistance level of $182. Through this time frame, the SPOT stock price has witnessed a whopping gain of roughly 126% since the start of 2023.

Factors Affecting Loss & Gain.

Spotify plans to integrate the $1 rise in monthly subscription price in the U.S. This move by the music giant will make the company profitable in the long run.

Around the globe, Generation Z helped to achieve the previous quarter a most profitable one as Spotify witnessed a sudden hike in listeners in the previous quarter.

Spotify is restructuring the podcast infrastructure, and increased music royalty costs result in quarterly losses.

The recent Taylor Swift’s “Eras Tour” by Universal Music resulted in recent price increases for Spotify.

Technical Analysis Of Spotify Stock Price.

The Relative Strength Index (RSI) trades at 39.48, RSI denotes the weakness in the market during the intraday session.

The Chaikin Money Flow score is -0.10, and the CMF indicates the rise in the participation of sellers in the market during the previous 24 hours.

The SPOT stock price is currently trading below the 20, 50, 100, and 200-day EMA, indicating weakness in the market. However, it reflects the heavy participation of sellers in the market.

The current market capitalization of Spotify’s stock price is $27.66 Billion with an average volume of 4.37 Million shares.

Conclusion

Spotify Technology S.A, has formed a collaboration with WPP plc which is a London-based multinational communication and advertising company to integrate the audio streaming platform into WPP’s products. Despite all these developments, Morningstar downgrades Spotify Technology to hold from buy, $170 price target. Presently market structure represents a bearish trend for about a monthly time frame. Investors should look for buying opportunities in the long run and vise-versa in the short run.

Technical Levels

Major support: $139.15 and $159.67

Major resistance: $182 and $152.80