- Bitcoin surpassed PayPal in the amount of value transfer.

- Some existing PayPal shortcomings can be the reasons for the same.

- However, Bitcoin is far from becoming comparable to VISA and MasterCard.

Comparing the amount of value transfer between existing payment giants like PayPal, Visa, Mastercard, and Bitcoin, is interesting to look at.

This is what the numbers say:

| Visa | $3.2 Trillion |

| MasterCard | $1.8 Trillion |

| Bitcoin | $489 Billion |

| PayPal | $302 Billion |

Visa and MasterCard numbers are incomparable, which is to be expected because of their longer presence in the payment market and with more users, but the comparison of Bitcoin and PayPal gives shocking results.

Bitcoin has surpassed PayPal in the value transfer per quarter. Some possible reasons for this, and what significance this holds, are further discussed in the article.

Why did PayPal become pale? A comparison with Bitcoin.

Bitcoin transactions can be done throughout the world, truly emphasizing the meaning of a global network. Although PayPal claims that it’s present in 200+ countries, it’s still limited to certain geographical sites only. Several Middle-East and African countries are not supported. This is not the case with Bitcoin.

Bitcoin runs on a trustless network, which has a high level of security, and the transactions once made are immutable in the blockchain. On the other hand, PayPal has a history of hacks and security breaches where the personal and financial data of its users were compromised.

The fact that PayPal is centralized compared to a decentralized Bitcoin cannot be ignored.PayPal headquarters serves as the central governing body for the service, and they can freeze assets or ban accounts whenever they desire. Several nodes, however, control the governance of Bitcoin with no central authority, and thus, users enjoy a greater degree of freedom.

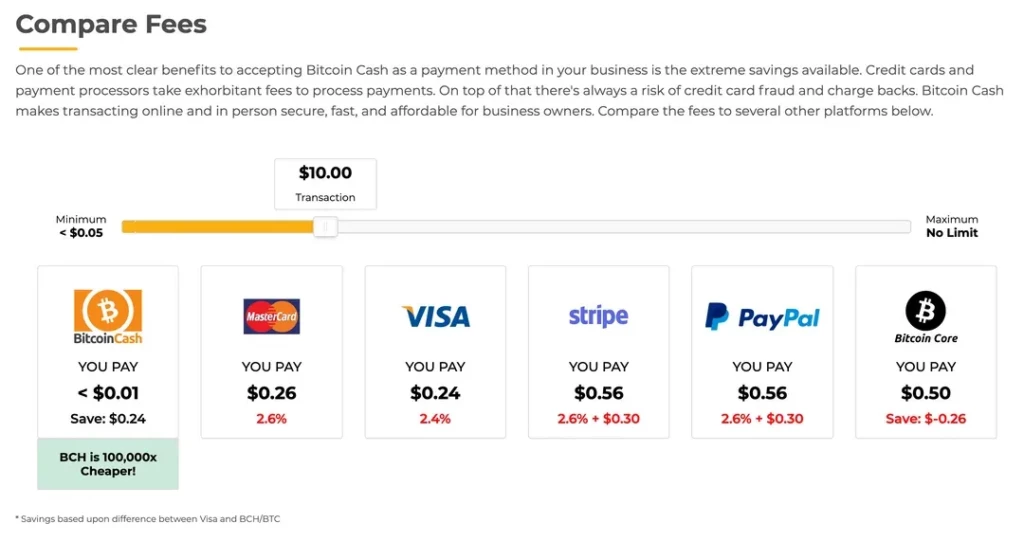

PayPal, like any other private company, charges some amount of money as their transaction fees but this amount is high compared to what bitcoin charges. For a $10 transaction, PayPal charges $0.56, whereas Bitcoin charges just $0.01.

PayPal has set an upper limit on the amount of money that can be sent. It is $10,000 in the US and €8000 in the European Union. The transfer limit on Bitcoin is NIL.

Another striking feature is protecting the anonymity of the user, where Bitcoin users are anonymous and can transfer money without revealing their identity, while this is not the case with PayPal.

The realization of such factors and a general increase in awareness of Bitcoin has led people to shift over to Bitcoins. Seeing this tremendous growth, we all think that one day Bitcoin can even surpass VISA. Let’s compare their numbers on some factors and discuss the results.

Transactions per day:

Bitcoin recorded nearly 280,000 transactions per day compared to VISA’s 597 million per day. This reason can be attributed to the blockchain technology over which Bitcoin is built, where decentralization is its basic pillar.

Although research and implementations are continuously being carried out to increase the blockchain’s scalability while still maintaining its security and decentralized nature, the number of transactions using Bitcoin and VISA is not comparable as of now.

No. of users:

The total number of Bitcoin users has ever increased since its launch in 2009 and now has reached somewhere between 250 to 300 million users. Among these are also those who are occasional users, and others who use it not for transactions but those who merely keep a crypto wallet.

As for VISA, the total number of cards out in the market is nearly 2.8 Billion, making VISA a household name. Just learning the release date of VISA, 1958, makes it clear why it is so popular.

Other Support to Bitcoin:

PayPal has realized the potential of Bitcoin and doesn’t want to be left behind in this competitive space. Thus, in October 2020, PayPal announced that it would allow its users to sell, buy, or hold cryptocurrencies through their App or Website.

In a similar fashion, VISA and MasterCard are also doing their own research in this area, and are bound to roll out features to adopt crypto into their system.

Many countries have included crypto income under business income and some have also included Bitcoins under taxation. Yet, it is still far from being recognized as a currency.

In general, people lack education in the domain of Bitcoin and feel comfortable using the existing systems, even when they are expensive and lacking in certain features.